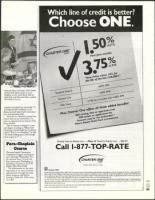

Which line of credit is better?

Choose ONE.

Menorah House volunteer Helen Maltz

of Oak Park lights candles at a pre-

Shabbat service, while Brian Saks of

Oak Park and Menorah House resident

Phil Ruskin look on.

a

chaplain has helped him personally. "It

has helped build confidence in me.

Being involved helps build communica-

tion and leadership skills.

And this is a volunteer position that

can be done at my convenience," he

said, an important factor because of his

busy schedule.

Saks is currently working on a mas-

ter's degree in biology at Wayne State

University, with his sights set on dental

school. "But it is so rewarding," he said.

"It's worth making sure I have enough

time to give to it."

ll these added benefi ts

or appraisal costs

der

tide

application fee

NO closing,

deductible

O points o

4O

Interest may be tax

Home Equity Gold Card convenience

❑

Para-Chaplain

Course

The next Jewish Community

Chaplaincy Program training ses-

sion will begin Wednesday, Oct.

29, and run from 7-9 p.m. for

four consecutive Wednesdays at

Fleischman Residence, 6710 W.

Maple, West Bloomfield.

For information on the train-

ing course or on other volunteer

opportunities through the chap-

laincy program, call Shirley

Jarcaig at (248) 661-2999, exten-

sion 300.

gAik&..',04fala;40.m1V.AegM,&::;:* ';'::•.a,, r3afs.fre4,„N.:TEzzEoTamA,:•,. wa

Already have an Equity Line — Move It! Need an Equity Line — Get It!

ifgliDER Member FDIC

`The 1.50% introductory Annual Percentage Rate (APR) is available for the first four months after activation. After four-month introductory period, fully indexed APR can change monthly based on Prime minus 1/4%, currently 3.15%. Offer subject to maximum combined 89.99%

LTV (loan to value) and a minimum $10,000 draw or balance transfer at time of dosing. The APR is Prime plus a margin, if any, if the $10,000 draw or transfer is not nude. Prime is the highest Prime Rate published in the "Money Rates" section of The Wall Street Journal

Prime is a variable rate; as it changes, the APR on your account will change. Annual fee of $100 will be due annually after the expiration of twenty-four (24) months from the date of activation of the agreement The Annual fee shall be waived for each year that it is due

if, for the immediately preceding 12 months, the average outstanding balance on the credit line account during such 12 months is 10% or more of the line of Credit Maximum APR is 16%.

Lines of Credit are limited to owner-occupied 1-4 family principal residences and are subject to our underwriting standards, which are available upon request Property insurance required. flood insurance may be required. Prepayment fee equal to I% of highest outstanding loan

balance owed since inception of the agreement or $350, whichever is greater, will apply if line of Credit Agreement is cancelled within one year of activation. Monthly payments of interest only will result in balloon payment at maturity. Offers are good on new Line of Credit

relationships only and are subject to change without notice.

Competitive pricing information obtained directly from banks through diligent effort the week of September 29, 2003. Comparison based on a 90% loan-to-value line request.

"'Consult a tax advisor regarding deductibility of interest. APRs effective as of October 8, 2003.

10/17

2003

53