Tuesday, May 24, 1977

THE MICHIGAN DAILY

Page Nine

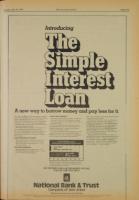

Introducing

A new way to borrow money and pay less for it.

Now, National Bank and Trust offers you a simpler LUMP-SUM PAYMENTS Here is one example of the way a Simple Interest

and better installment loan. It's called the Simple Any amount can be paid, any time, to reduce the Loan can save you money.

Interest Installment Loan. With it, you pay in- principal. The earlier your payment is made Let's say you buy a car, use your old car as a

terest only on the money you use, tot the number in the life of the loan, the greater the savings in down payment and finance the balance of

of days you use it. There's no interest added on interest charges. $3,500 on a 36-month loan. With an Annual Per-

in advance, as in conventional installment loans In short, each payment you make reduces the centage Rate of 11.33% your monthly payments

used by the other local banks, principal balance of your loan And only with a would be $115.13. The sum of the payments

With Simple Interest Loans, we simply figure Simple Interest Loan is interest recalculated would be $4,144.68 of which $644.68 is the total

the interest on the unpaid balance of your when each payment is made. finance charge on the loan. At origination,

loan each time a payment is made. So any time You can use a Simple Interest Installment Loan this looks the same whether it's a conventional

you reduce that balance ahead of the agreed to borrow money for any worthwhile purpose. loan or a Simple Interest Loan.

payment date, you'll save on interest charges. Whether it's a new car, a vacation, or anything at Now-say that at two months, you have an

For instance: all, you'll find it's the better way to borrow! extra $200 that cango toward payingoff your loan.

EARLY MONTHLY PAYMENT Theway most banks ange loans, you'd only

Any time you make a payment ahead of the save $2.84 by paying that $200 in addition to

grd duedat, you have tfit many mri your regular ayment. But with an NBT Simple

days with a lower unpaid balance- so you siveest Loan the sm estr payment d

pay less interest.

MULTIPLE PAYMENTS ACTUAL SAVINGS

Making more than one paymen at a time OTHER BANKS, CONVENTIONAL LOAN

reduces the loan principal even mor so you

save on interest charges again

S10 $20 $30 140 $50 $60 $70

Example based on $200.00 extra payment at two

months in addition to regular monthly payment:

on a $3,500.00 36-month loan

PAY INTEREST ONLY ON THE MONEY YOU USE,

FOR THE TIME YOU USE IT.

iU

National Bank & Trust

Company of Ann Arbor

NOT Simple interest Loans Available Only At NOT Offices:

ManorliWatsirgton Wit am at Thompson S a Sttium a Packard a Westgate Shopping Center 0* WaOstenaw auPitsield Bivd "Ar*rorcland Shoppn CntScrn. OB rwo Mnil

115bBroadway. Pymnouth and Greenroadsc E Huron River Dove at Clark Road aMeani U 9Wunustano 541 W Mao.OrCLi nt19W)811