Elf]

'D

CONFIDENTIAL CASH!

LTC!

'D

Gold, Diamond and

Estate Jewelry.

Some banks have had to set

aside additional sums to their

loan-loss provisions because they

have overstepped these guide-

lines. Virtually all banks are

"loaned out," so that there is lit-

tle money left for the real-estate

sector.

Finally, developers do not

want to take any chances with

the uncertain foreign residents'

market. Due to the political sit-

uation, developers have put a

hold on Israeli building projects

geared to foreign residents.

On the supply side then, there

are several serious problems, the

most acute being the credit

crunch which has deeply affect-

ed the developers' ability to fi-

nance new projects.

The demand side is somewhat

less complicated. Based on sta-

tistics regarding young married

couples and projected aliyah, Is-

rael needs about 50,000 units per

year.

Absorption Minister Yuri

Edelstein has predicted higher

immigration, particularly from

the Commonwealth of Indepen-

dent States (CIS - the former So-

viet Union) in the coming year.

Experience has shown that

immigrants from the CIS have

quickly moved from being

renters to home owners, so that

the demand for homes should

not decrease.

The bottom line seems to be

then that Economics 101 applies

to this situation, namely, rising

or steady demand but lower sup-

ply.

Why then are prices not ris-

ing?

Clearly, the meteoric rise of

housing prices over the last few

years cannot last forever. In dol-

lar terms, the increase in hous-

ing prices from 1989 to 1995

exceeded 155 percent.

The same Economics 101

teaches that something has to

give when prices rise so high so

quickly.

Economists predict a 5 percent

reduction in housing prices for

1997 in real terms. It would

seem then that while prices may

come down somewhat in 1997, it

should not be a huge drop or for

an extended period.

Potential buyers who are en-

titled to government benefits (za-

kaim) should also keep in mind

that Ministry of Housing officials

have hinted that there will be no

adjustment for inflation in the

benefits package. This means

that the erosion in real terms of

these benefits may not make it

worth putting off the purchase

of an attractive home.

Market dynamics more often

than not have a life of their own

and predicting trends is a very

risky business.

However, it seems that a full-

fledged, long-term real-estate cri-

sis in Israel, a la New York or

London, seems unlikely. 1

(c) Jerusalem Post 1997

Large Diamonds, Watches,

Sterling, Signed Costume

Jewelry. Antiques, Oriental

Rugs, Art Glass, 50s and

Classic Furniture. Complete

Estates. High Value Items.

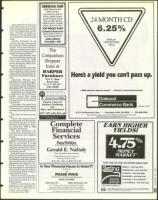

24 MONTH CD

6.25%

TOP PRICES PAID!

Unlimited Resources

Call for private in-home or

bank vault appointment.

Andy Adelson

810-206-1100

S

P

ANNUAL

PERCENTAGE

YIELD

d

The

Comparison

Shopper

buys at

HARPER

Furniture

Here a yield you can't pass up.

916 N. Main

Royal Oak

(N. of 11 Mile Rd.)

545-3600

• $500 minimum opening deposit • Interest compounded quarterly

clia

Oakland

Commerce Bank

of ••ce clahiers

Finest Line of

Italian Clothing

for

Men and Women!

31731 Northwestern Hwy. • Farmington Hills, MI 48334 • 810-855-0550

20% Off with this ad

Rates subject to change without notice. Substantial penalty for early withdrawal.

Annual Percentage Yield is effective as of 1-6-97.

1045 Orchard Lake Rd • Svh.an Lake

810-3321 1811

Complete

Financial

Services

EARN HIGHER

YIELDS!

4.75 9i°

PaineWebber

Invest With More Intelligence

Gerald E. Naftaly

MONEY

MARKET*

Vice President-Investments

32300 Northwestern Hwy., Suite 150

Farmington Hills, MI 48334

(810) 851-1001 or (800) 533-1407

Is Your Financial House In Order??

To find out

call

VISIT ONE OF OUR LOCATIONS NEAR YOU!

Sterling

PHASE FOUR

bank

&trust

(810) 559-6980

TRISH WELLMAN, CFP

1 711 7 West 9 Mile Road, Southfield, MI 4 80 75

Phase Four Advisory, Registered Investment Advisor

Securities offered through Vestax Securities Corporation, Member, NASD & S1PC

1931 Georgetown, Hudson, 01 -144236 (216) 650-1660

BERKLEY • (810) 546-2590

BIRMINGHAM • (810) 646-8787

Cn

Cr)

CLAWSON • (810) 435-2840

Certified Financial Planning Professionals

JOEL LEVI, CFP

Member FDIC

ROCHESTER • (810) 656-5760

SOUTHFIELD • (810) 948-8799

W. BLOOMFIELD • (810) 855-6644

> -

CC

<7(

We create solutions."®

FDIC

ANNUAL PERCENTAGE YIELD EFFECTIVE AS OF I 1/15/96. RATES SUBJECT TO CHANGE WITHOUT

NOTICE. - MONEY MARKET: 52.500 MINIMUM BALANCE REQUIRED. STATEMENT FEES MAY REDUCE

EARNINGS IF MINIMUM BALANCE IS NOT MAINTAINED.

61