Community

Kaplow Heads

Historical Society

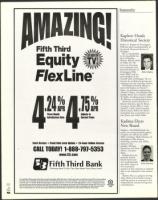

Fifth Third

Equity

FlexLinew

.14:111.15:1

11

Three Month

Introductory Rate

Adjusts to

Current Prime

Kadima Elects

New Board

Card Access • Fixed Rate Lock Option • 24-hour Online Access

.

CALL TODAY! 1-888491-5353

fin

JN

6/7

2002

40

Robert D. Kaplow of Farmington

Hills has been elected president of

the Jewish Historical Society of

Michigan.

He is a shareholder

in the Southfield law

firm of Maddin,

Hauser, Wartell, Roth

& Heller PC. He

serves on the execu-

tive committee and

board of directors of

Robert Kaplow

Farmington Hills-

based JARC and is a

past president of the

Cornell Club of Michigan. He is a

lecturer for professional groups per-

taining to tax and corporate matters.

The Historical Society officers to

serve with Kaplow are Harriet E

Siden, vice president-programming;

Charles I. Mayer, vice president-mem-

bership; Benno Levi, treasurer; Adele

W. Staller, recording secretary; Robert

W. Feldman, corresponding secretary.

Historical society directors are

Sharon Alterman, Joan R. Braun,

Cynthia I. Brody, Ellen S. Cole,

Gerald S. Cook, Stuart Gorelick,

Myrle Leland, Robert M. Rubin.

Immediate past co-presidents are

Joan Braun and Adele Staller.

www.53.com

Fifth Third an

Working Hard To Be The Only Bank You'll Ever Need!

Upon qualification. When opened, the introductory Annual Percentage Rate (APR) will be fixed at 4.24% for three months up to 80% loan-to-value (LTV) or for those qualifying

for a Prime + 0% line, with Prime rate for the line thereafter. For 81-90% LTV, introductory rate is 5.24% with Prime + 1% thereafter. For 91-100% LTV, introductory rate is

6.24% with Prime + 2% thereafter. $5,000 initial draw required to receive introductory rate. As of 4-01-02 the variable APRs ranged from 4.75% to 6.75% based on LTV and

other factors. Rates may vary and are indexed to the Prime Rate as published on the last business day of the month in the Wall Street Journal. Maximum APR of 25% in OH, IL, EQUAL HOUSING

MI &TN; 24% in KY; 21% in IN; 18% in FL &WV $50 annual fee waived for one year. In Florida, documentary stamp tax and intangible taxes apply. Terms and conditions

LENDER

subject to change without notice. No other discount applies. Fifth Third and Fifth Third Bank are registered service marks of Fifth Third Bancorp. Member FDIC.

Kadima, a Southfield-based non-

profit, non-sectarian health agency,

installed new officers for 2002-

2003: president, Merle Schwartz of

Farmington Hills; Barbara

Eisenberg, secretary; Jim Miller,

treasurer; Sissi

Lapides, Michael

Kratchman and Perry

Ohren, vice presi-

dents.

Kadima has nine

privately funded

family homes and

two condominiums

Merle Schwartz

that allow clients to

live in personal

quarters as they volunteer at selected

sites or are employed in the commu-

nity.

Kadima Plus is a program serving

older adults with in-home services;

enabling seniors to continue to live

independently and preventing insti-

tutionalization.