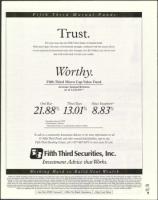

Fifth Third Mutual Funds

Trust.

Put your trust into the Fifth Third family of mutual funds.

With more than 100 years of investment strength, combined with the sound advice

of our experienced investment team who manages over $35 billion, you can be sure

that we'll work hard to build your wealth.

worthy.

Fifth Third Micro Cap Value Fund

Average Annual Returns

as of 12/31/01**

One Year

Three Years

Since Inception*

21.88% 13.01% 8.83%

* Inception date of 211198

** Investment C Shares

Past performance is no guarantee of future results.

To talk to a trustworthy Investment Advisor or for more information on all

31 Fifth Third Funds and other mutual fund families, stop in any

Fifth Third Banking Center, call 1-877-887-0273 or visit www. 53. corn.

lin Fifth Third Securities, Inc.

Investment Advice that Works.

Working Hard to Build Your Wealth

**With 1% CDSC (contingent deferred sales charge). The performance data quoted represent past performance and is not an indication of future results. For the period prior to August 13, 2001, the

quoted performance of the Fund reflects the performance of the Investor Shares of the Fifth Third/Maxus Equity Fund, adjusted to reflect the expenses and sales charge for the Investment C Shares. On

August 13, 2001, that Fund, a registered open-end investment company managed by Fifth Third Fund Asset Management, Inc., was merged into Fifth Third Micro Cap Value Fund. Investment return

and the net asset value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than they originally cost. There are risks associated with investing in small-cap companies,

which tend to be more volatile and less liquid than stocks of large companies, including the increased risk of price fluctuations. For more information on the Fifth Third Funds, including fees, expenses,

ongoing charges and historical fund performance, call 1-888-799-5353 for a prospectus. Please read the prospectus carefully. before investing or sending money. Fifth Third Asset Management, Inc. serves

as Investment Advisor to the Fifth Third Funds and receives a fee for its services. The Fifth Third Funds are distributed by Fifth Third Funds Distributor, Inc., 3435 Stelzer Road, Columbus, OH 43219,

which is not affiliated with the Investment Advisor. Fifth Third Funds and other investment products offered through Fifth Third Securities, Inc , member NASD and SIPC:

• Are Not FDIC Insured

• Offer No Bank Guarantee

• May Lose Value

4/12

2002

7

Scanned image of the page. Keyboard directions: use + to zoom in, - to zoom out, arrow keys to pan inside the viewer.

April 12, 2002 - Image 163

- Resource type:

- Text

- Publication:

- The Detroit Jewish News, 2002-04-12

Disclaimer: Computer generated plain text may have errors. Read more about this.