For

With Medicare

and Social

Security

reaching the

breaking point,

many are

looking at

long-term care

insurance

policies.

ERIC BAUM

LU

SPECIAL TO THE JEWISH NEWS

Cr)

I-U

I--

CD

CC

LLJ

UJ

58

Eric Baum is a registered

representative for John

Hancock Distributors.

PHO TO BY DANIEL LI P PITT

ilt ,

Aging

- \

im and Sheryl Bloom, ages 45 and suggest a mounting finan-

44, have better reasons than a cial epidemic and few im-

morbid fascination with their de- mediate solutions.

Mike Conners, senior

pendency years to buy long-term

care insurance policies while in program director for south-

their 40s.

east Michigan for Citizens

The Farmington Hills based For Better Care, is con-

husband-and-wife attorney team of Bloom cerned Michigan's Medic-

& Bloom P.C. recently added a new facet to aid fund will be bankrupted

their retirement plans which pays antici- by the Blooms' generation

pated nursing home or home health care unless changes are adopt-

costs.

ed soon.

"We want our money and our lives to end

`The system at present is

at the same time. We wouldn't want one per- ill-equipped to handle the Sheryl and Jim Bloom: A long-term plan.

son to bankrupt the other if we get sick," tremendous future growth

said Mr. Bloom.

of people who will need some form of as- pend on Medicaid for their long term care

needs. Medicaid kicks in only after all re-

Seeing personal injury clients' costs of sisted-living benefit," said Mr. Conners.

care on an almost daily basis prompted the

Medicare covers the first 20 days in a maining assets are spent down to $75,000

Blooms to ponder how well their own nursing home after a mandatory three-day per spouse, a sparsely furnished home, one

nestegg would weather a lengthy illness af- hospital stay. Patients who spend the re- car, two prepaid graves and a modest

ter retirement.

maining 80 days of Medicare benefit must amount of life insurance.

Giving away assets to appear poor enough

Mr. and Mrs. Bloom know they are rid- require therapy or need supervised medical

ing the crest of the largest and most costly attention. These patients, called skilled or to qualify for Medicaid benefits is called di-

emerging age group. Figures from the U.S. intermediate who qualify for full Medicare vestment. Under the Health Insurance

Bureau of the Census project the number of benefits, account for roughly five percent of Portability and Accountability Act of 1996,

the government can impose fines and jail

Americans living beyond the age of 85 will the total long-term care population.

double in the next 25 years and multiply

More than 40 percent of Americans de- time for those found guilty of hiding assets

to qualify for Medicaid benefits.

fivefold by the year 2050.

"Most people begin pay-

The New England Journal of

ing for long-term care out

Medicine said in 1991 that

of their pockets and turn to

roughly 43 percent of all Amer-

Medicaid when their assets

icans over the age of 65 may

have been used up and the

need some form of assisted liv-

system is still not ready to

ing. When push comes to shove,

....

meet the needs of an aging

odds suggest one of the Blooms

population," said Mr. Con-

will eventually live in a nursing

ners.

home, and it will be expensive.

Kenneth E. Konop, an

"We know what it costs," said

attorney specializing in es-

Mrs. Bloom. "We have friends

tate planning at Miller,

who work at nursing homes and

Canfield, Paddock and

friends who own them. What we

Stone, PLC, refers to parts

bought today will not only be

of the new legislation as

good for when we're 70-85, but

"throw an old person in

something could happen at any

jail" provisions. Divest-

time."

ment was formerly used to

Considering nursing home

shelter personal assets

rates already range between

from nursing homes' col-

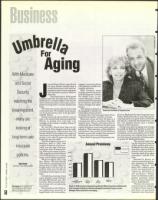

CNA-

John

The

$35,000-$80,000 per year, Mr.

UNUM Life

Continental Casualty

Hancock

Travlors

Insurance

lection departments.

and Mrs. Bloom's early atten-

Company

Mutual

Insurance

"Persons who have sub-

tion to long-term care planning

stantial reserves will have

is prudent.

Based on $100 per day nursing home benefit and $50 per day home health benefit.

to deplete those assets if

Demographics and inflation,

Data compiled by Michigan Medicare/Medicaid Assistance Program and the

•

they have not purchased

two juggernauts presently at

Michigan Office of Services to the Aging.

long-term care insurance.

loggerheads with one another,

41

Annual Premiums