or future voluntary agreements.

Stiff financial penalties must be

applied by the United States and

donor countries for explicit antag-

onistic actions, including Pales-

tinian National Authority failure

to halt all violence against Israelis,

expansion or building of new Is-

rael settlements, and the use of in-

flammatory language.

And fourth, periodic shuttle

diplomacy by American envoys is

woefully inadequate. A continu-

ous American presence with bold

Oval Office backing is required.

Intervals between visits by the

able and dedicated Middle East

negotiator Dennis Ross repeated-

ly have witnessed deterioration in

Palestinian-Israeli relations.

Rather than realigning the last

agreement gone awry, it would be

more expedient and efficient if Mr.

Ross and colleagues could devote

time to building layers of trust.

Either settle as many issues as

possible in an intensive Camp

David-like summit or series of

summits, and/or provide for a per-

manent and proactive American

mediating presence in Jerusalem.

Washington must use its com-

parative advantage as trusted in-

termediary. Mr. Arafat and Mr.

Netanyahu must be pulled along

by Washington. Just as the Unit-

ed States and the international

community must penalize viola-

tions, they also must guarantee

the final agreement with econom-

ic incentives and monitoring per-

sonnel.

A heavy price must be imposed

and paid by each side for failure to

reduce tension. Quicken the pace.

Delineate borders. Separate the

populations. Resolve the tough

questions. Deepen American en-

gagement. Cut to the end-game

now. ❑

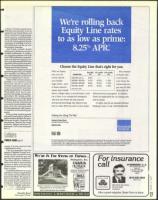

We're rolling back

Equity Line rates

to as low as prime:

8.25% APR

Choose the Equity Line that's right for you.

With our Equity

Plus, because

Up to 80% 81% to 90% 91% to 100%

Variable

Rate

LIV

LTV

-

LTV

Line, you can

an Equity Line

access cash for

$100,000 and up

8.25%

is secured by

$99,999 -$50,000

8.75%

10.25%

11.25%

your family's

your home, the

$49,999 - $25,000

9.25%

10.25%

11.25%

larger needs...such

interest rate you

$24,999 -$3,500

9.75%

10.25%

11.25%

as home improve-

pay may be fully

Rates effective 3/3/97

ments loan consoli

deductible for

dation, college tuition, a second home, a new federal income tax purposes. In addition,

car or boat, or an unexpected emergency.

there's no application fee, no closing costs

And you can choose the loan amount

and no points.

and annual percentage rate, based on the

To apply, stop by any Standard Federal

loan-to-value (LTV) you have in your home.

Banking Center or call 1-800/HOME-800.

Helping You Along The Way.

Standard Federal Bank

Savings/Financial Services

800/643-9600

Member

FDIC

PUBLIC CARE page 24

county. It is to be voted on in the

Legislature in June.

I feel it is imperative that the

people of Oakland County be in-

formed as fully as possible on the

needs which must be met and

how they are going to be financed.

Then they will be in a better po-

sition to be able to communicate

by phone or letter to the state leg-

islators on the course they wish

them to follow.

It certainly behooves us to pay

attention to what is happening in

our society and take action to de-

termine the effects. We cannot af-

ford a steamrolling of problems in

the mental-health system by al-

lowing Gov. Engler to arbitrarily

and perhaps illegally make deci-

ould be disastrous

/- -) s:

n, • ;illy

but for all.

Dorothy Rood

Huntington Woods

Standard

Federal

cr

* The Annual Percentage Rate (APR) applicable to your account will vary depending on your credit limit and the loan-to-value ratio. The APR is determined by taking

the weekly average prime rate as published by the Federal Reserve Board during the last week of March, June, September and December and adding a margin.

The maximum APR is 18%. A balloon payment may be due at maturity. You must carry insurance on the property that secures your Equity Line. Consult your

tax advisor regarding the tax deductibility of interest. Tax laws are subject to change and individual tax situations vary. ©1997 Standard Federal Bank

WE'RE IN THE SWING OF THINGS...

Swingsets, Inc.

ChildlifE

0 TRACK'

c For insurance

call

SY WARSHAWSKY, C.L.U.

7071 Orchard Lake Road

Suite 110

In the J&S Office Bldg.

W. Bloomfield, MI

48322

• SPECIAL SPRING PRICES

• MODELS ON DISPLAY

(810) 626-2652

Office Phone

Widest selection of wooden backyard

playsystems in tri-county area.

EARLY SPRING DELIVERY STILL POSSIBLE

V SHOP

OLDIER

3947 W. 12 Mile

Berkley

(810) 543-3115 • M-SAT 10-5:30 • FRI 10-8

See me for car, home,

life and health

insurance

Like a good neighbor. State Farm is there.

27