6

T HE DETROIT JEWISH NEWS — Friday, April 13, 19 62 —

Va. Governor Signs Bill Revoking Nazi Charter

been preferable to ignore the

RICHMOND, Va., (JTA)

Governor Albertis S. Harrison;group," the Virginia chief ex-

has signed a bill passed by the ' ecutive said that, in effect, all

the legislature accomplished by

state legislature here revoking passage of its bill" is to deny

the charter of the American the Nazi party the status of a

Nazi Party, but declared in a Virginia corporation."

statement issued after the sign-

However, since the measure

in;_* that the Nazi party will still had been adopted, the Governor

he able to use the word "Nazi" stated, he would not "substitute"

his judgment and opinion above

in its organizational title.

Stating that "it would have that of the legislature.

Jewish Committee Blasts Far Right

A batch of 1,300 swastikas,

costing $29.64, was taken out of

circulation this weekend by the

head of a manufacturing firm

in West New York, N.J., which

had made the Nazi symbols on

the order of souvenir merchants

—then found himself picketed

by trade unionists who objected

to the "insidious" emblem.

Want ads get quick results!

NEW YORK, (JTA) — The

American Jewish Committee hit

extreme right-wing movements

in this country for "preaching

fear and despair" and an unwill-

ingness "to accept the responsi-

bilities of mature citizens to

carry the burdens of free world

leadership."

The statement charged that in

supposedly defending the most

cherished American institutions,

the extreme right has chosen

methods "which surely corrupt

American's civic morality." Most

of their weapons, it said, "such

as indiscriminate name calling,

smearing of public officials and

private citizens and even reli-

gious leaders," are borrowed

from the Communists, "past mas-

ters of the strategy of infiltra-

tion, capture and subversion."

Only one state, Washington,

bears the name of a President.

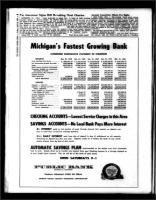

Michigan's Fastest Growing Bank

CONDENSED COMPARATIVE STATEMENT OF CONDITION

RESOURCES

Dec. 31, 1960

Dec. 31, 1961

Mor. 31, 1962

$ 3,702,760.30

3,850,326.83

15,395,156.93

643,231.41

$ 8,238,904.88

5,012,259.71

23,037,363.46

1,282,260.95

$ 8,263,263.09

8,612,188.92

38,605,459.78

1,181,320.14

$ 8,401,805.52

8,537,615.55

41,332,596.48

1,260,105.37

610,661.01

118,836.37

67,085.76

29,137.82

$24,417,196.43

596,606.55

154,952.70

83,913.88

49,565.90

$38,455,828.03

576,789.53

324,221.99

111,625.54

64,619.07

$57,739,488.06

907,085.98

320,517.26

116,286.92

70,702.77

$60,946,715.85

$13,351,804.41

7,793,330.15

$21,145,134.56

$21,584,587.78

13,659,304.63

$35,243,892.41

$25,683,705.31

25,768,278.64

$51,451,983.95

$25,342,441.86

28,732,135.63

$54,074,577.49

610,661.01

9,096.55

45,962.21

67,676.70

2,000,000.00

400,000.00

206,342.10

596,606.55

9,945.29

34,779.65

165.00

2,000,000.00

400,000.00

170,439.13

$ 8,841,357.00

$24,417,196.43

$38,455,828.03

576,789.53

646,012.20

83,943.23

20,816.07

4,000,000.00

400,000.00

294,396.64

265,546.49

$57,739,488.06

907,085.98

938,237.15

72,888.46

20,172.96

4,000,000.00

400,000.00

227,075.30

306,678.51

$60,946,715.85

Dec. 31, 1958

Cash and Due from Banks

U.S. Government & Other Securities

Loans

Bank Premises, Furniture & Equipment..

$ 1,093,591.62

1,395,269.88

6,075,292.73

235,313.15

41,889.62

$ 8,841,357.00

Dec. 31, 1959

Customers' Liability on Acceptances

and Letters of Credit

Income Earned, Not Collected

Prepaid Expenses

Other Resources

TOTAL RESOURCES

LIABILITIES

Deposits — Demand

$ 4,744,415.48

2,629,264.82

Deposits — Savings and Time

$ 7,373,680.30

TOTAL DEPOSITS

Bank's Liability on Acceptances

and Letters of Credit

Income Collected, Not Earned

Accrued

Expenses

Other Liabilities

1,000,000.00

Common Stock

400,000.00

Surplus

Undivided

General

Profits

Unallocated

TOTAL

Reserve

LIABILITIES

CHECKING ACCOUNTS— Lowest Service Charges in this Area

SAVINGS ACCOUNTS No Local Bank Pays More Interest

4% INTEREST

paid on that portion of every Savings Account that remains on deposit one

year or more (four consecutive calendar quarters).

3'/2%

DAILY INTEREST

paid from day of deposit to day of withdrawal on all amounts

remaining on deposit less than one year. Deposits made on or before the tenth of any month

receive interest from the first of that month.

AUTOMATIC

SAVINGS PLAN recommended as the easiest and most convenient

way to save. Simply direct us to transfer any amount from your Checking Account to a Savings Account or

to your Credit Union Account. This we will do on the tenth of each month.

OPEN SATURDAYS 9 -1

Al'AirMBWANW ARZAWRS

DETROIT 31, MICHIGAN

Telephone WOodward 5-0505 (All Offices)

MEMBER FEDERAL DEPOSIT INSURANCE CORPORATION